- Investing

- >

- Portfolios

- >

- Value

- >

- Buffet

Buffet

This is a value-oriented portfolio loosely based on Warren Buffet's acclaimed Berkshire Hathaway.

Buffet is well known for his strategy of sticking to his "circle of competence," otherwise known as the businesses he understands the most.

The best way to identify value companies is to truly understand the business of the companies in question. If you don't understand them, how will you know when there is value?

For this reason, sticking to your expertise and circle of competence is one of the best ways to construct a portfolio.

Buffet has his own areas of expertise that influence his investments, but your areas of expertise may be quite different.

Use this example portfolio as a reference for building your own unique portfolio based on a circle-of-competence-weighting strategy, with each area of the market you know better holding a larger allocation in your portfolio.

A helpful guide might be to make a list of the areas of the market about which you are the most knowledgeable. Once you have that list, weight the sectors or companies on that list in a manner proportionate to your knowledge.

Just remember not to overinvest in any one sector and, most importantly, not to overestimate your competence in any given area of business or the market.

If you don't know enough about a company or industry, don't invest. Stick to what you know and allocate your portfolio accordingly.

*Any investor seeking to perfectly match Buffet's investments would be inclined to consider investing in Berkshire Hathaway ($BRK.B) directly, but this model portfolio offers a template to loosely mirror the firm's general approach to investing.*

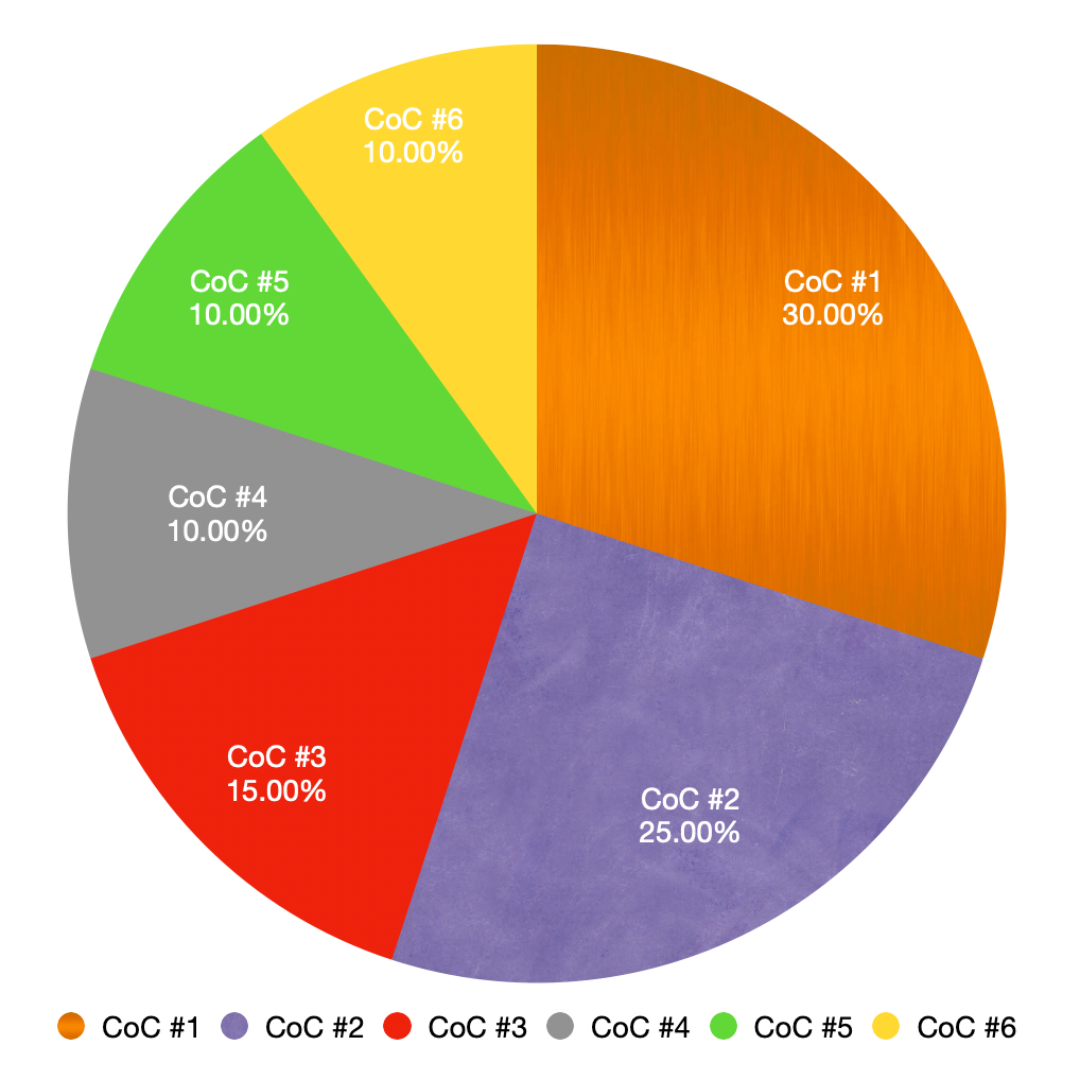

Sector Allocations:

Circle of Competence #1 - 30%

Circle of Competence #2 - 25%

Circle of Competence #3 - 15%

Circle of Competence #4 - 10%

Circle of Competence #5 - 10%

Circle of Competence #6 - 10%

---------------------------------------------------------------------------------------

*All portfolio allocations illustrated or discussed, whether depicting asset classifications, categories, subcategories, or any specific asset, are for informational and educational purposes only. This is not investment advice.*

---------------------------------------------------------------------------------------