A Complete Guide To Taxes

Tax Day

If you're a calendar year filer and your tax year ends on December 31, the due date for filing your federal individual income tax return is generally April 15th of each year. If you use a fiscal year (tax year ending on the last day of any month other than December), your return is due on or before the 15th day of the fourth month after the close of your fiscal year. If your due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

Extension To File

If you cannot file by the due date of your return, you should request an extension of time to file. To receive an automatic 6-month extension of time to file your return, you can file Form 4868. File your extension request by the due date of your return. An extension of time to file is not an extension of time to pay so you'll owe interest if the tax you owe isn't paid by the original due date of your return. You may also be subject to a late-payment penalty on any tax not paid by the original due date of your return.

What Is Taxable Income?

Taxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

What Is a Tax Bracket?

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat.

Tax Brackets and Rates

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows.

There are seven federal income tax rates in 2022:

Single

10% - $0 to $10,275

12% - $10,275 to $41,775

22% - $41,775 to $89,075

24% - $89,075 to $170,050

32% - $170,050 to $215,950

35% - $215,950 to $539,900

37% - $539,900 or more

Married

10% - $0 to $20,550

12% - $20,550 to $83,550

22% - $83,550 to $178,150

24% - $178,150 to $340,100

32% - $340,100 to $431,900

35% - $431,900 to $647,850

37% - $647,850 or more

Head of Household

10% - $0 to $14,650

12% - $14,650 to $55,900

22% - $55,900 to $89,050

24% - $89,050 to $170,050

32% - $170,050 to $215,950

35% - $215,950 to $539,900

37% - $539,900 or more

What Is the Standard Deduction?

The standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts And Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

The larger the standard deduction, the less income is subject to taxation. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction to $12,000 for single filers (up from $6,500 pre-TCJA), $24,000 for joint filers (up from $13,000 pre-TCJA), and $18,000 (up from $9,550) for heads of household.

The standard deduction is a fixed amount for all taxpayers depending on their filing status. Conversely, itemized deductions are various expenses which may be listed to reduce taxable income for taxpayers who, for example, make charitable contributions, pay state and local taxes, or deduct the interest payments on their mortgage. Itemized deductions are more uniquely tailored and favored by taxpayers in higher-income brackets.

Taxpayers tend to choose the deduction option that lowers their taxable income the most and maximizes what they keep. The TCJA increased the standard deduction, eliminated the personal exemption, and reduced eligible expenses and amounts of itemized deductions, to encourage more taxpayers to opt for the less complex route of claiming the standard deduction. The standard deduction is administratively easier for the taxpayer to elect and for the IRS to compute and benefits most taxpayers in the lower income brackets more than itemizing.

Deductions

Deduction in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A deductible item is subtracted from the total taxable income which can substantially reduce taxes owed by an individual or corporation. Often charitable contributions, other taxes, healthcare costs, capital losses, and many business expenses can be deducted, but what can be deducted and how much varies based on the jurisdiction and whether the tax is for an individual or organization. On the federal level, an alternative tax minimum limits the amount many individuals can deduct from their taxes. For example, if an individual made $300,000 with a tax rate of 25%, the taxes would be $75,000, but if the individual had $50,000 worth of deductibles, that person would only owe $25,000 ($75,000-$50,000=$25,000). However, if there was a minimum tax rate of 10% for individuals with income over $100,000, that person would be required to pay the minimum of $30,000 ($300,000*.1=$30,000).

How Credits and Deductions Work

When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe.

Deductions can reduce the amount of your income before you calculate the tax you owe.

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don't owe any tax.

Advance Child Tax Credit

By claiming the Child Tax Credit (CTC), you can reduce the amount of money you owe on your federal taxes. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

Because of the COVID-19 pandemic, the CTC was expanded under the American Rescue Plan of 2021. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. When you file your 2021 tax return, you can claim the other half of the total CTC.

Earned Income Tax Credit

If you earn a low to moderate income, the Earned Income Tax Credit (EITC) can help you by reducing the amount of tax you owe. To qualify, you must meet certain requirements and file a tax return. Even if you do not owe any tax or are not required to file, you still must file a return to be eligible. If EITC reduces your tax to less than zero, you may get a refund.

Deductions for Charitable Donations

You may be able to claim a deduction on your federal taxes if you donated to a 501(c)3 organization. To deduct donations, you must file a Schedule A with your tax form. With proper documentation, you can claim vehicle or cash donations. Or, if you want to deduct a non-cash donation, you'll also have to fill out Form 8283.

Energy Tax Incentives

Energy-related tax incentives can make home and business energy improvements more affordable. There are credits for buying energy efficient appliances and for making energy-saving improvements.

Capital Gains

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

Long-term capital gains are taxed using different brackets and rates than ordinary income.

Capital assets generally include everything owned and used for personal purposes, pleasure, or investment, including stocks, bonds, homes, cars, jewelry, and art. The purchase price of a capital asset is typically referred to as the asset’s basis. When the asset is sold at a price higher than its basis, it results in a capital gain; when the asset is sold for less than its basis, it results in a capital loss. Although capital gains taxes typically apply to the returns from any capital asset, including housing, U.S. homeowners benefit from a generous exemption for gains resulting from the sale of their primary residence, set at $250,000 for single filers ($500,000 for joint filers).

In the United States, when a person realizes a capital gain, they face a tax on that gain. Capital gains tax rates vary depending on two factors: how long the asset was held and the amount of income the taxpayer earns. If an asset was held for less than one year and then sold for a profit, it is classified as a short-term capital gain and taxed as ordinary income. If an asset was held for more than one year and then sold for a profit, it is classified as a long-term capital gain.

Because capital gains are only taxed when realized, taxpayers can choose when they pay, which makes capital income significantly more responsive to tax changes than other types of income.

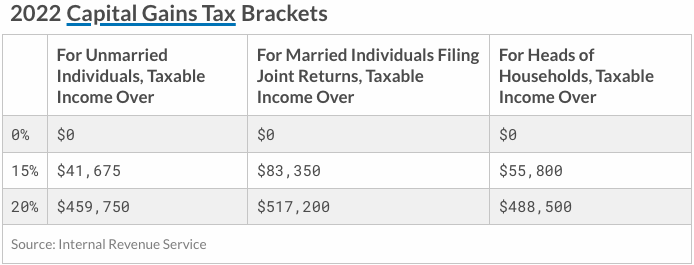

Long-Term Capital Gains Tax Brackets and Rates

Single

0% -$0

15% - $41,675

20% - $459,750

Married

0% - $0

15% - $83,350

20% - $517,200

Head of Household

0% - $0

15% - $55,800

20% - $488,500

Short-Term Capital Gains Tax Brackets and Rates

Single

10% - $0 $9,950

12% - $9,951 to $40,525

22% - $40,526 to $86,375

24% - $86,376 to $164,925

32% - $164,926 to $209,425

35% - $209,425 to $523,600

37% - $526,601 or more

Married

10% - $0 to $19,900

12% - $19,901 to $81,050

22% - $81,051 to $172,750

24% - $172,751 to $329,850

32% - $329,851 to $418,850

35% - $418,851 to $628,300

37% - $628,301 or more

Head of Household

10% - $0 to $14,200

12% - $14,201 to $54,200

22% - $54,201 to $86,350

24% - $86,351 to $164,900

32% - $164,901 to $209,400

35% - $209,401 to $523,600

37% - $523,600 or more

State-By-State Capital Gains Tax Rates

California - 13.30%

Hawaii - 11.00%

New Jersey - 10.75%

Oregon - 9.90%

Minnesota - 9.85%

Vermont - 9.75%

New York - 8.82%

Iowa - 8.53%

Wisconsin - 7.65%

Maine - 7.15%

South Carolina - 7.00%

Connecticut - 6.99%

Idaho - 6.93%

Montana - 6.90%

Arkansas - 6.90%

Nebraska - 6.84%

West Virginia - 6.50%

Louisiana - 6.00%

Rhode Island - 5.99%

Virginia - 5.75%

Maryland - 5.75%

Georgia - 5.75%

Kansas - 5.70%

Missouri - 5.40%

North Carolina - 5.25%

Massachusetts - 5.05%

Oklahoma - 5.00%

Ohio - 5.00%

Mississippi - 5.00%

Kentucky - 5.00%

Alabama - 5.00%

Utah - 4.95%

Illinois - 4.95%

New Mexico - 4.90%

Colorado - 4.63%

Arizona - 4.54%

Michigan - 4.25%

Delaware - 3.40%

Indiana - 3.23%

Pennsylvania - 3.07%

North Dakota - 2.90%

Wyoming - 0.00%

Washington - 0.00%

Texas - 0.00%

Tennessee - 0.00%

South Dakota - 0.00%

New Hampshire - 0.00%

Nevada - 0.00%

Florida - 0.00%

Alaska - 0.00%