- Investing

- >

- Basics

- >

- Financial Statements

- >

- Cash Flow Statement

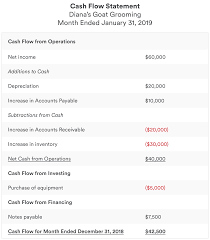

Cash Flow Statement

The cash flow statement shows the amount of cash and cash equivalents entering and leaving a company.

The cash flow statement (CFS) measures how well a company manages and generates cash to pay its debt obligations and fund operating expenses.

The cash flow statement is derived from the income statement by taking net income and deducting or adding the cash from the company's activities shown below.

The three sections of the cash flow statement are:

- Cash from operating activities

- Cash from investing activities

- Cash from financing activities

Operating Activities

Operating activities on the CFS include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from the sale of a company's products or services.

Changes made in cash, accounts receivable, inventory, and accounts payable are shown in cash from operating activities and might include:

- Receipts from sales of goods and services

- Interest payments

- Income tax payments

- Payments made to suppliers

- Salaries and wages

Investing Activities

These activities include any incoming or outgoing cash from a company's long-term investments. Investing activities include:

- A purchase or sale of an asset

- Loans made to vendors or received from customers

- Merger or acquisition payments or credits to cash

Financing Activities

These activities include cash from investors or banks, as well as the use of cash to pay shareholders. Financing activities include:

- Payment of dividends, which are periodic cash payments to shareholders

- Payments for stock purchases, which reduces the number of outstanding shares

- Repayment of debt principal (loans)

A balance sheet is a summary of the financial balances of a company, while a cash flow statement shows how the changes in the balance sheet accounts–and income on the income statement–affect a company's cash position. In other words, a company's cash flow statement measures the flow of cash in and out of a business, while a company's balance sheet measures its assets, liabilities, and owners' equity.

Key features:

- Shows the increases and decreases in cash

- Expressed over a period of time, an accounting period (i.e., 1 year, 1 quarter, Year-to-Date, etc.)

- Undoes all accounting principles to show pure cash movements

- Has three sections: cash from operations, cash used in investing, and cash from financing

- Shows the net change in the cash balance from start to end of the period