- Investing

- >

- Basics

- >

- Financial Statements

- >

- Balance Sheet

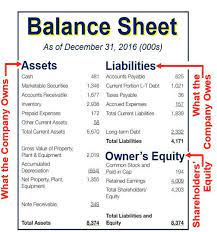

Balance Sheet

A balance sheet shows what a company owns in the form of assets and what it owes in the form of liabilities.

A balance sheet also shows the amount of money invested by shareholders listed under shareholders' equity.

The balance sheet shows a company's assets, but also shows how those assets were financed, whether it was through debt or through issuing equity. The balance sheet is broken down into three parts: assets, liabilities, and owners' equity, and it is represented by the following equation:

Assets = Liabilities + Owners’ Equity

Where Owners’ Equity = Total Assets - Total Liabilities

To calculate the balance sheet, one would add total assets to the sum of total liabilities and shareholders' equity.

The balance sheet shows a snapshot of the assets and liabilities for the period, but it does not show the company's activity during the period, such as revenue, expenses, nor the amount of cash spent.

The asset section begins with cash equivalents, which should equal the balance found at the end of the cash flow statement. The balance sheet then displays the changes in each major account from period to period. Net income from the income statement flows into the balance sheet as a change in retained earnings (adjusted for payment of dividends).

Key features:

- Shows the financial position of a business

- Expressed as a “snapshot” or financial picture of the company at a specified point in time (i.e., as of December 31, 2017)

- Has three sections: assets, liabilities, and shareholders equity

- Assets = Liabilities + Shareholder Equity