- Trading

- >

- Strategies

- >

- Stop-Loss Liquidity Grab

Stop-Loss Liquidity Grab

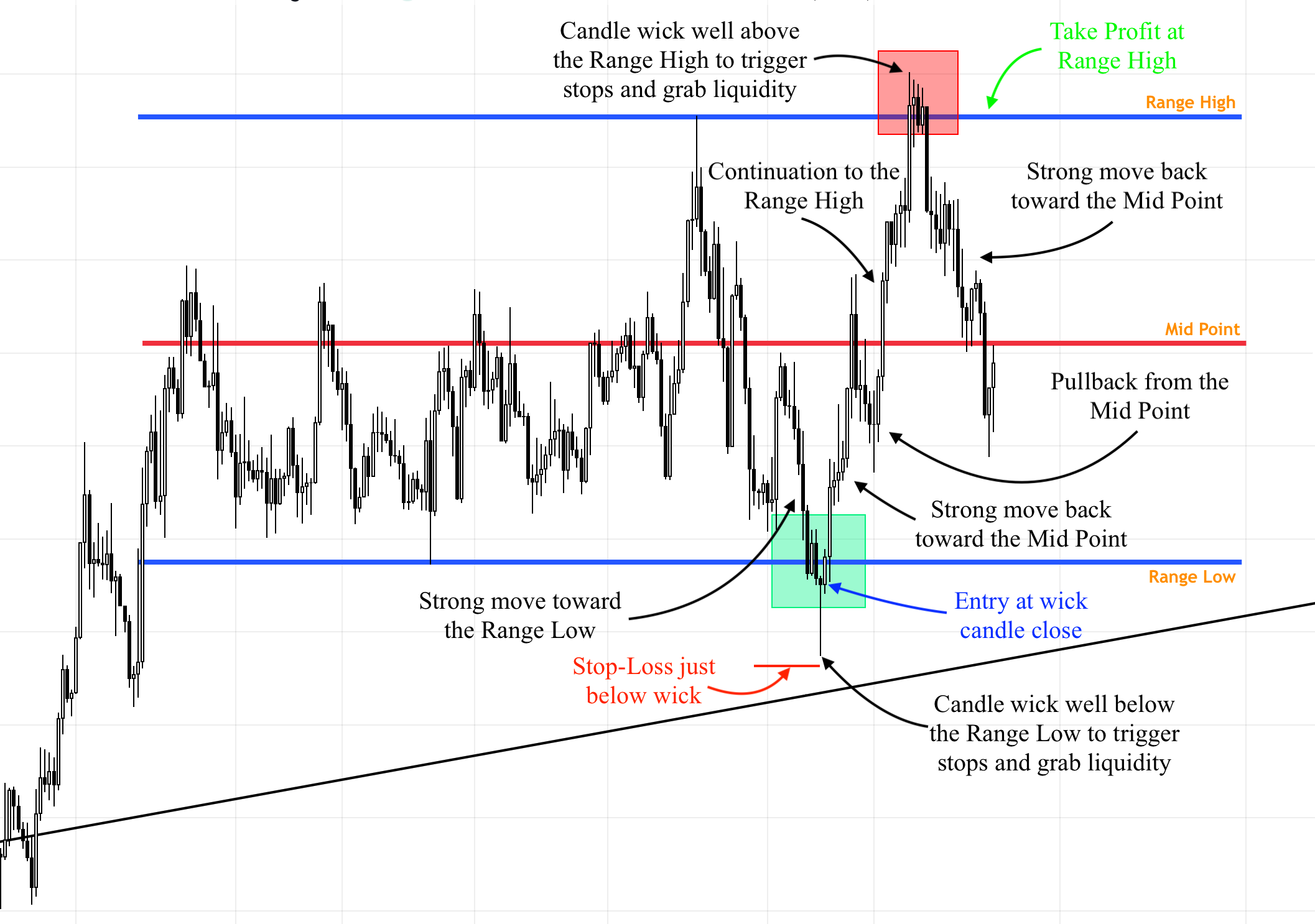

This strategy is based on the assumption price gravitates to where the liquidity is, which is often where trader buy-stops or sell-stops are placed. Many retail traders place their stop-losses just beyond what they believe are key levels of resistance or support only to see price go just past those stop-losses to grab their liquidity and eventually shoot back toward the desired direction.

Keeping this in mind, you will want to identify key levels where retail traders are likely to place their stop-losses, which is usually around the high/low of the day (HOD/LOD), recent swing high/low, or higher timeframe range highs/lows. All too often price moves past these key levels just enough to stop out the average trader, grab their liquidity, and consequently prevent them from profiting on the sharp move to follow.

This strategy attempts to enter around these stop levels after price has sufficiently moved beyond the aforementioned key levels and shown a clear sign of rejection (usually a strong bullish or bearish candle in the opposite direction) or accumulation. The moves can be quick so the entries are often at or around the closing price of that bullish or bearish candle moving in the opposite direction of the previous trend. You can always wait to enter during the subsequent candle and see if price retraces a bit, which is often the case, but as long as your stop is beyond the wick high/low of the previous bullish/bearish candle, you should be just fine entering at that closing price of the reversal candle.