- Trading

- >

- Strategies

- >

- Spread Trades

Spread Trades

Spread trading is a fairly popular strategy that aims to capture the difference between two assets in percentage terms.

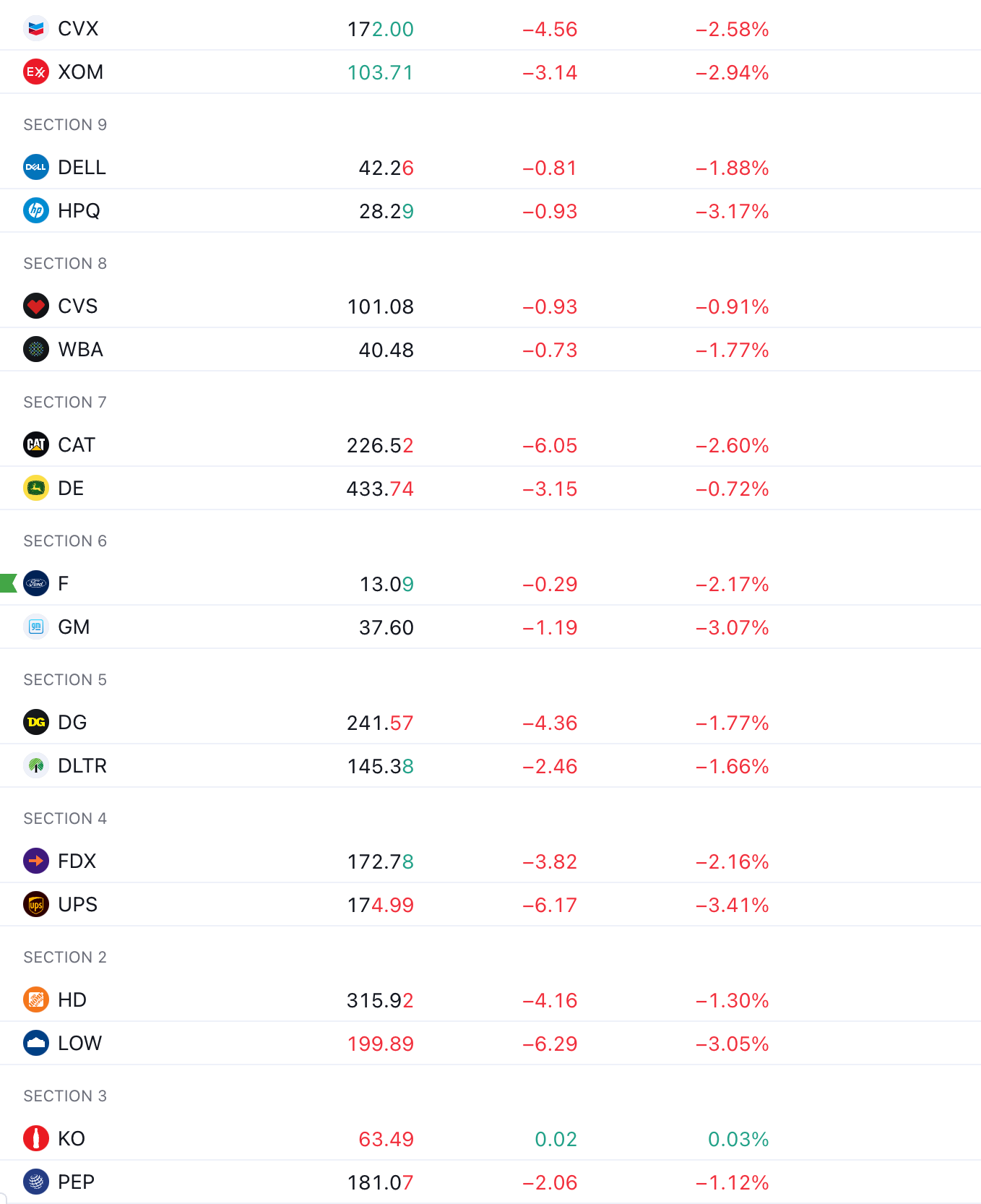

Generally, assets in a spread trade are very similar, such as $F and $GM, $KO and $PEP, $HD and $LOW, $BTC and $ETH, and so on.

Similar assets like these tend to have a consistent percentage range either asset deviates from the other. This trend can vary over time, but it will move according to a fairly predictable pattern over smaller periods.

As an example, $KO could gain or fall in percentage terms against $PEP from time to time, but over the last month, it might have done so within, say, a 3% range before reverting back to the mean.

In other words, the spread between the two will usually tighten (revert to the mean) after a 3% gain or loss vs the other.

Leading into mid-session or over a day or two, $KO might be up 4% while $PEP is only up 1%, but in the following hours/days, $KO will presumably retrace or $PEP will catch up to bring that spread back toward a more normalized level. Spread parity, if you will.

In short, you are hoping to profit from the spread between two similar (highly correlated) assets tightening when one rises or falls more than normal relative to its counterpart.

And because you will be long one asset and short the other, you have very limited risk with a market-neutral hedge baked into the strategy.

WHERE TO FIND HISTORICAL SPREADS BETWEEN ASSETS:

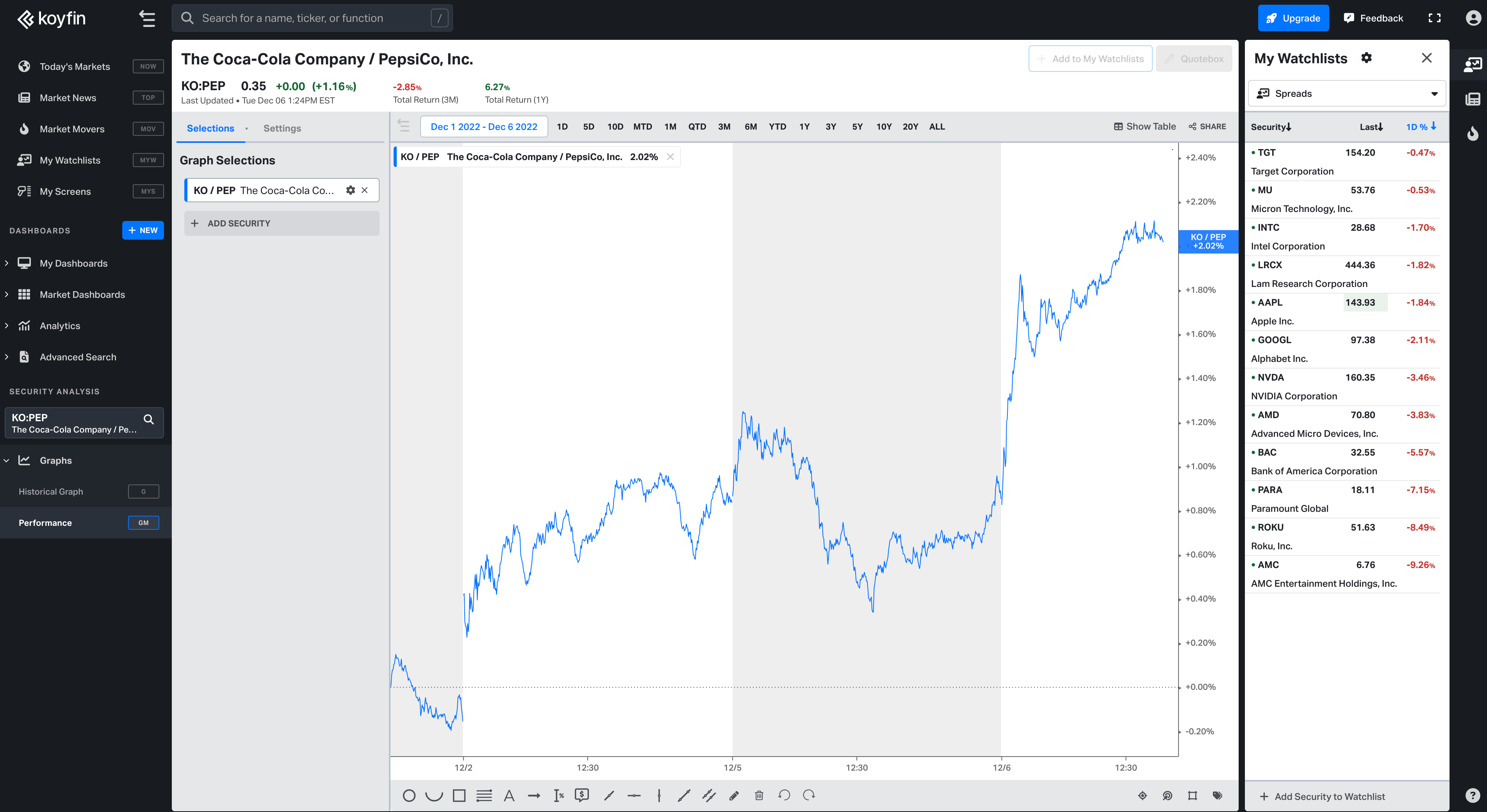

To view spreads between assets, you can check out the site Koyfin. Head to the Security Analysis section near the bottom of the lefthand window and type whatever two assets you are looking to trade in the format “KO:PEP.” Then click on the Graph dropdown and select the Performance graph, not the Historical graph.

Focusing on the most recent spread range (last couple days or weeks) is recommended, but you’re welcome to trade off of whatever timeframe suits your holding period.

Also, keep in mind that the first asset you type in ($KO in the above example) is the asset you would be looking to long. You can always type the assets in the opposite order if you are bullish on the other, but remember the relevance of the order when looking to execute the trade.

*While spread trades are technically a mean reversion trade, you can view the Koyfin charts for asset spreads as any other chart and trade it like any other technical analysis-based trade. Outlining basic ranges and support/resistance levels is very helpful.*

WHEN TO EXECUTE SPREAD TRADES:

The first thing to watch when looking for spread trades is percentage moves of the pairs in question. You should create a watchlist of the different pairings you come up with and look for large differences between these pairs throughout the day.

If Home Depot ($HD) is up 3% and Lowe’s ($LOW) is only up 1.5% with no news, that could be a good candidate for a spread trade.

Once you have a candidate, you can head to Koyfin to see if the spread chart confirms a good trading opportunity.

When you see a spread between assets at the lower- or upper-bound of its daily/weekly range or at a key support/resistance level on Koyfin at the same time the current (intraday) percentage difference (spread) is extended, that is likely a good trade to make.

If you decide to pull the trigger, be sure to short the asset that is overbought/undersold (leading its counterpart) and long the asset that is oversold/underbought (lagging its counterpart) until the spread tightens.

PROFIT LEVELS TO KEEP IN MIND:

- In % terms (exit as soon as you make 1-3%).

- At the midpoint of the Koyfin chart range.

- At the opposite end of the Koyfin chart range.

- At the next key level of the Koyfin chart.

Oftentimes, you won’t even need to look at the Koyfin chart. Just knowing the max amount an asset generally gains or loses against its pair counterpart can be enough. As soon as you see one pair move x% up or down relative to the other, you can jump into the spread for some degree of mean reversion.

The volatility of any given pair will dictate when it’s more or less appropriate to enter and will also dictate your profit levels to a certain extent. More volatile pairs can have 3+% swings (targets) while other pairs max at around 1%.

Nevertheless, if a spread difference for the day isn’t at least 1%, don’t trade it.

DISCLAIMER:

These historical spreads are by no means a guarantee, but given pairs like the ones mentioned are highly correlated, your risk is very controlled even if you end up being wrong.

Exercising risk management and always having a specific point (whether it be a dollars-lost level, price level, or percentage level) is extremely important. Risk-to-reward still matters, so keep your stop-losses tighter than your take-profits. (Ex: risk -0.50% to make 1.50%).

Any spread between assets can deviate from its trend at any given time, but the recent range within which that spread trades is reliable enough to exploit an edge. Moreover, any deviations likely won’t be dramatic or long lasting absent some major catalyst for one of the assets.

That said, there are a lot of reasons one asset in a pair can move aggressively against the other, such as earnings, an analyst upgrade, or any number of other reasons, so don’t assume a spread will always revert back to a mean or move in your favor.

Spread trades are not going to be high risk-to-reward trades, but they are excellent for consistent 1%-3% wins.