- Trading

- >

- Strategies

- >

- Range Deviation Retest

Range Deviation Retest

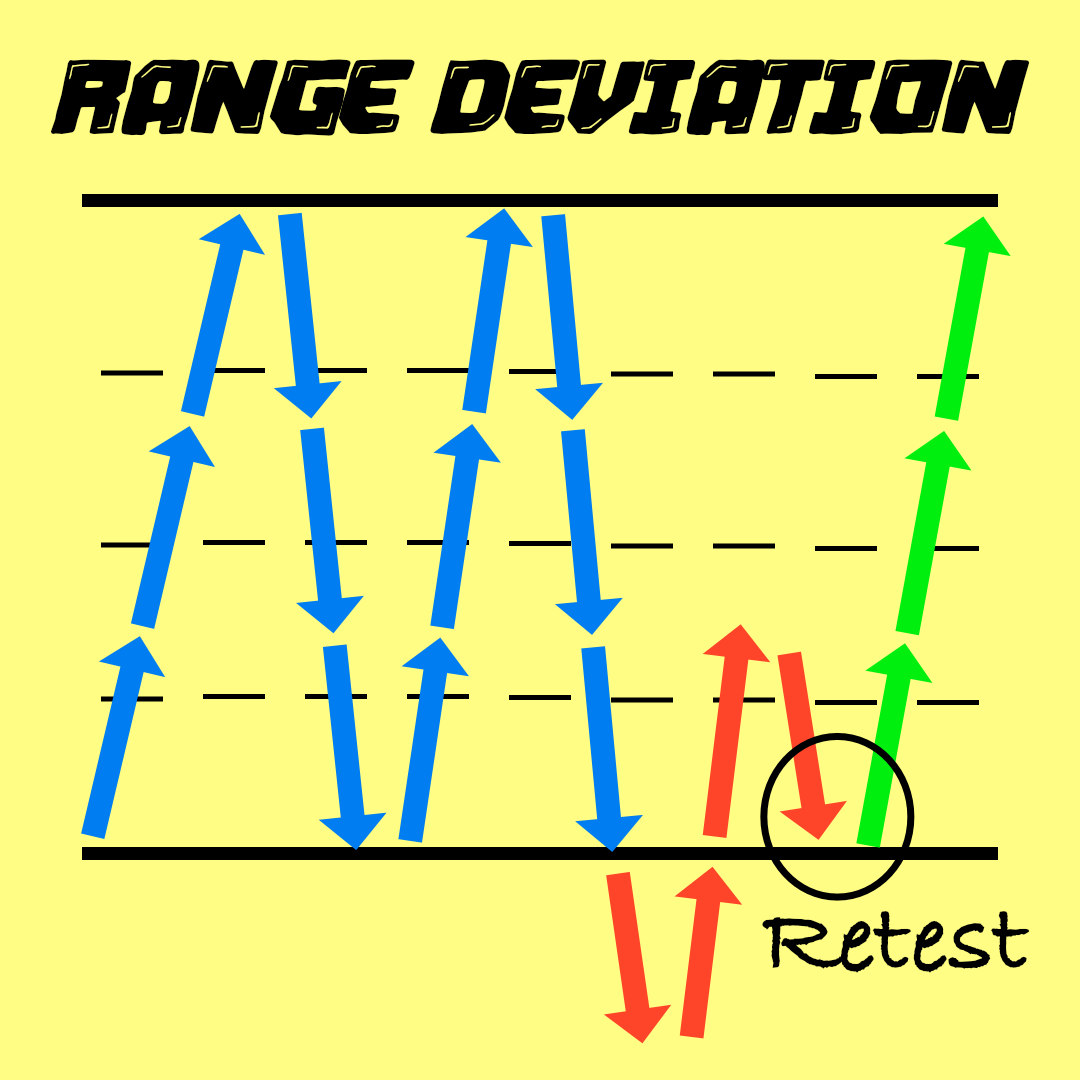

The Range-Deviation-Retest is a simple nearly self-explanatory strategy based on a price range and a small deviation above or below that price range high or low, respectively.

When price is trading within a range, whether from a LTF (Lower Time Frame) or HTF (Higher Time Frame) perspective, deviations from that range are arguably the most significant moves insofar as they present some of the best risk-to-reward opportunities.

Tops and bottoms of ranges are often where the most liquidity and movement enter the market, so it should be a major focus or key level to watch when considering entering or exiting any trade.

Irrespective of the direction a market goes at its range high or low, meaningful price moves frequently take place at or around those levels, meaning great trading opportunities consistently arise at or around those levels.

If price is trading near its range high and pushes beyond it, it could signal a new trend and range are about to be established, but it could also be a liquidity grab that ends with price quickly moving back into its range and, ultimately, testing the other side of that range.

The key to capitalizing on these opportunities is simple: once you identify the range and recognize price has deviated from it, you simply need to investigate which directional move is more likely (up or down) based on the price action that follows.

Naturally, this is easier said than done, but the biggest hurdle to overcome within this strategy is overcomplicating your analysis. You want to let price tell you where it’s going rather than guess where it’s going as soon as you see any deviation.

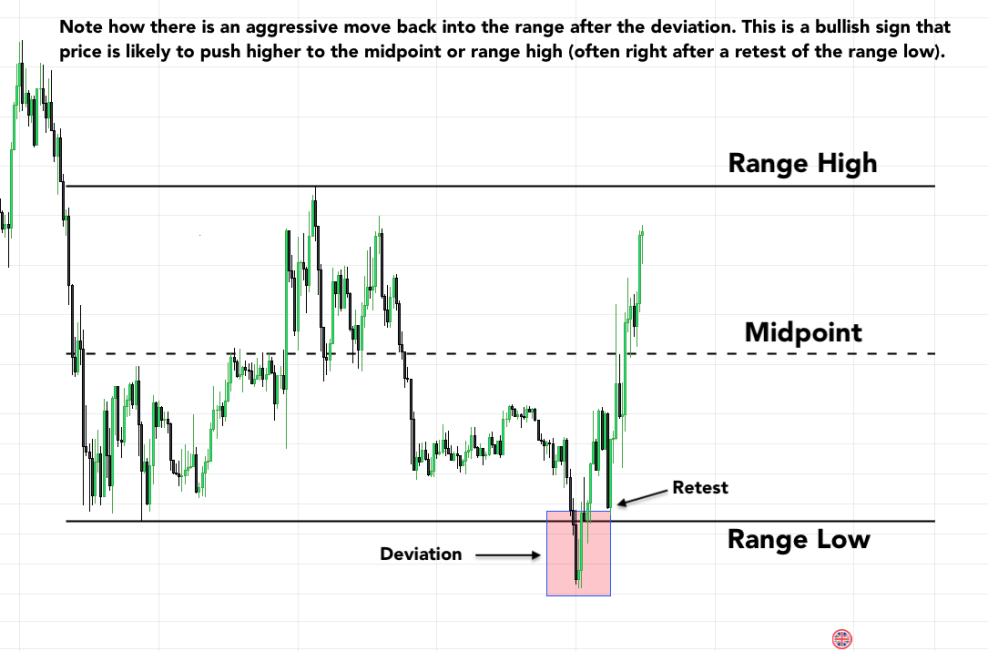

If price reenters its range with vigor, that is a good sign the deviation isn’t the start of a new trend or range being established. Rather, it’s rejecting a new trend or range and giving you an opportunity to trade price back up or down into its current range.

After a deviation, you will look to the range high or low as an anchor. As an example, if price moves below the range low but aggressively shoots back into the range with the following candles, you should look for a retest of the range low to go long and target the midpoint and/or range high.

Conversely, if price deviates above the range high and aggressively shoots back into the range with the following candles, you should look for a retest of the range high to take it short to the midpoint and/or range low.

An important thing to keep in mind about this strategy is that retests do not always perfectly come back to the range low or high.

Using the range high/low can still be a reliable entry point, but take note of any potential supply/demand zones near the range high/low that are created when the deviation reenters the range.

Another helpful tool is to use line charts to place your entry at the range high/low according to the candle closes, not wicks. You can also use these candle closes for your stops and targets if desired.

In the attached pictures, you can see this in line and candlestick form.

Some questions to help walk you through your analysis:

1. Has price returned to the range after its deviation?

2. Was the return to the range aggressive or modest?

3. Did price create any supply/demand zones or other imbalances when it returned to the range?

4. Has price already touched the midpoint or other side of the range since the deviation?