- Trading

- >

- Strategies

- >

- Mr. Mid

Mr. Mid

SUMMARY:

This trading strategy is based around the midpoint of price ranges.

When price is trading within a range, the midpoint tends be a significant point of support or resistance.

If price pushes above the midpoint and finds support, it frequently trades all the way to the range high.

Conversely, if price pushes to the midpoint and finds resistance, it frequently trades back to the range low.

As such, entering at the midpoint of the range once this directional bias has been decided and targeting the range high/low offers a high probability trading opportunity.

DRAWING RANGES:

To properly trade this strategy, you will have to properly draw your ranges.

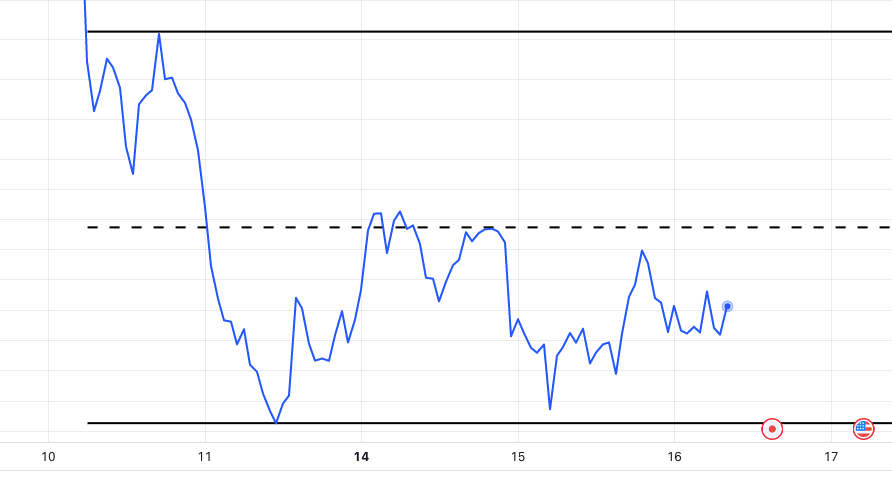

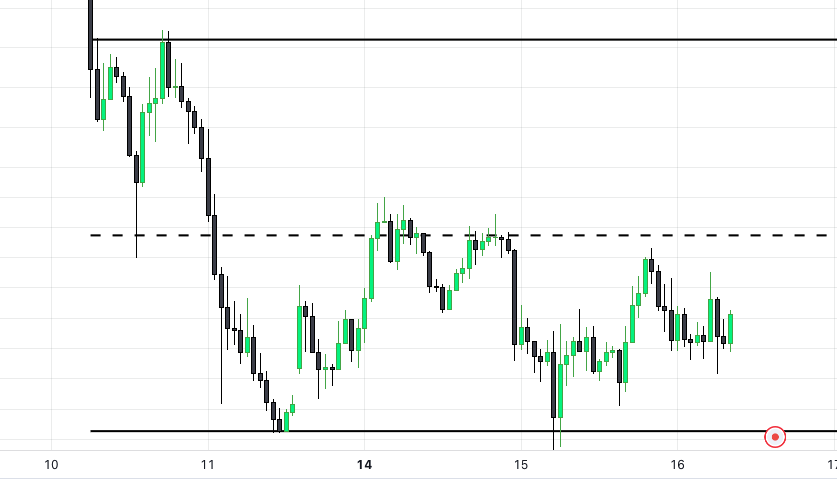

To do this, you’ll first have to choose your timeframe. Once you have that decided, you will want to change your chart to a line chart (not candlestick).

Ranges based on candle closes (not wicks), which is what the line chart shows, provide more reliable levels. This difference isn’t always significant, but using line charts is still a good habit.

In the attached pictures, you can see the difference between the line and candlestick charts.

EXCECUTION:

The key to this strategy is waiting for price to reach the midpoint of the range to gauge the reaction.

Price will usually break through the midpoint at first, possibly with just a candle wick, but the part to focus on will be the candle closes that follow.

After the first touch of the midpoint (and the close of that candle), you will want to wait for following candle closes above or below it to decide your long or short bias.

This strategy is fractal and, thus, applicable to any timeframe, but confirmation that price is using the midpoint of the range as support or resistance (candle closes) will depend on the timeframe you are trading.

If you are trading a 15m range and you see price moving toward the midpoint, you’ll want to wait for the first 15m candle that touches the midpoint to close and then wait for three consecutive 15m candle closes above or below the midpoint.

If you are trading a 1h range, you’ll want to wait for the first 1h candle that touches the midpoint to close and then wait for a three consecutive 1h candle closes above or below the midpoint, and so on.

For any timeframe, if the candle closes above the midpoint, enter long and target the range high. If the candle closes below the midpoint, enter short and target the range low.

In the attached pictures, you'll see a chart example with an order. This trade is based on a 1h range, so the entry wasn’t placed until three consecutive 1h candle closes below the midpoint:

RISK-TO-REWARD:

While you are welcome to use whatever risk-to-reward suits you, backtesting has shown a 1:2 R:R is the most reliable.

Price action around the midpoints of ranges can be somewhat volatile as the market decides if it is support or resistance, but a 1:2 R:R has proven to be most effective at avoiding whipsaws while still reaching the ultimate target.

That being said, there are times where you can clearly tighten your stop to achieve a 1:3 R:R or better. You’ll have to gauge that on a case-by-base basis, but 1:2 should be the default.

OTHER CONSIDERATIONS:

Over-managing midpoint trades can be counterproductive because liquidity grabs constantly gravitate toward the midpoint (often right before reaching the range high/low).

Feel free to move your stop-loss after 1R of profit, but also be open to not managing these trades at all.

If price breaks through the midpoint all the way to the range high/low without you getting your entry, consider the trade invalid and start fresh on any subsequent moves back to the midpoint.