Best Crypto Tax Software

Summary

Distaste for taxes is one of the few things we can all agree on, but that unified hatred doesn’t make the problem of filing taxes any less real or frustrating.

And as if taxes weren’t already challenging enough, now we have a mountain of crypto transactions nobody seems to know how to tackle.

Luckily, though, you don’t have to conquer that problem yourself. As this burgeoning crypto industry continues to expand, so, too, do the services around it, including much-needed tax software solutions.

With that in mind, we’ll be diving into the best crypto tax software out there so you can outsource that headache and go back to hating your taxes an average amount.

Let this best-of review be your guide to simplifying your crypto taxes (and life) by sidestepping this complicated and evolving space with the best hands-off crypto tax software solutions.

TokenTax (Most Advanced)

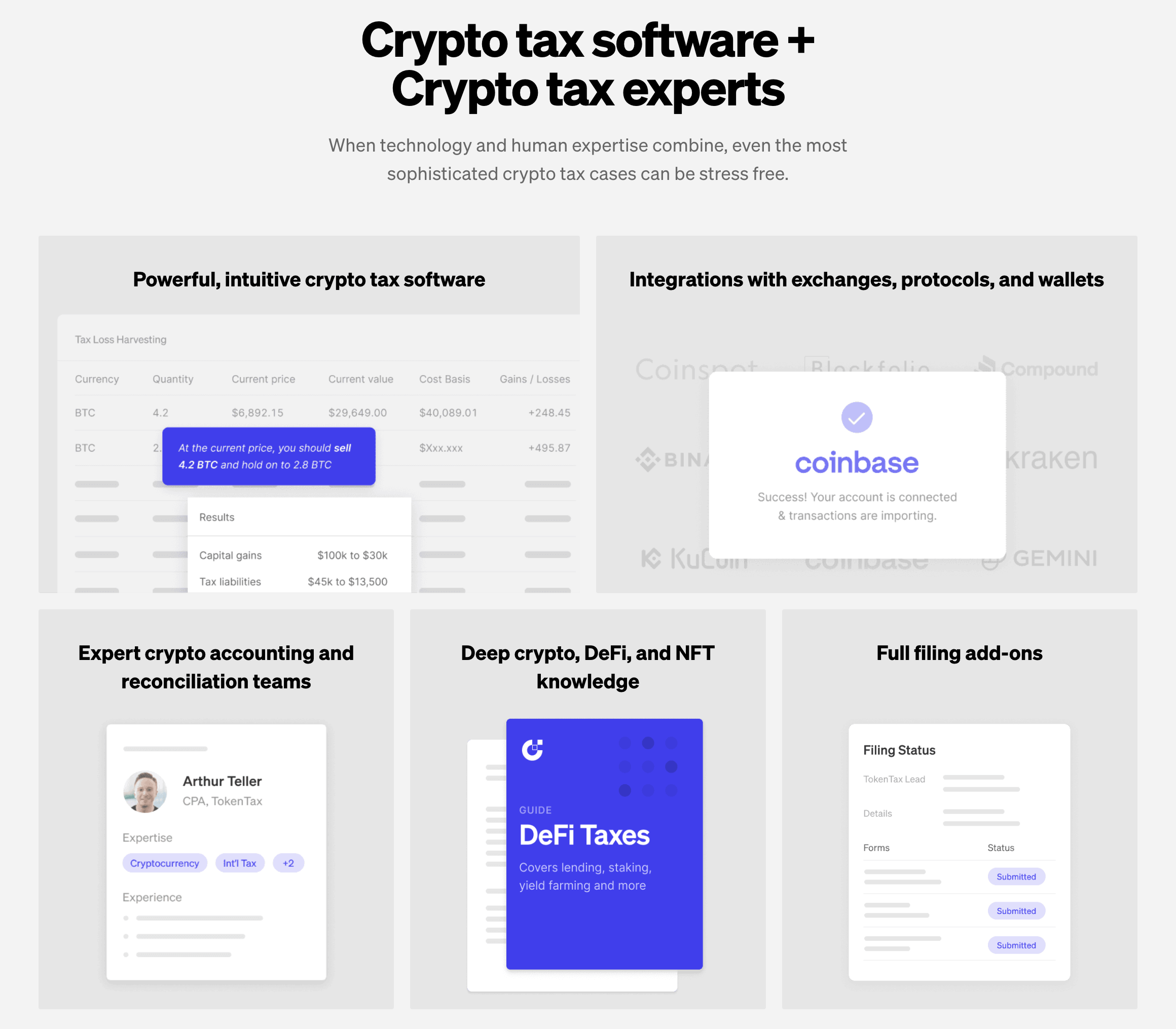

TokenTax is a cryptocurrency tax software, calculator, and full-service accounting firm that provides everything crypto traders and investors need to file their transaction data completely and correctly.

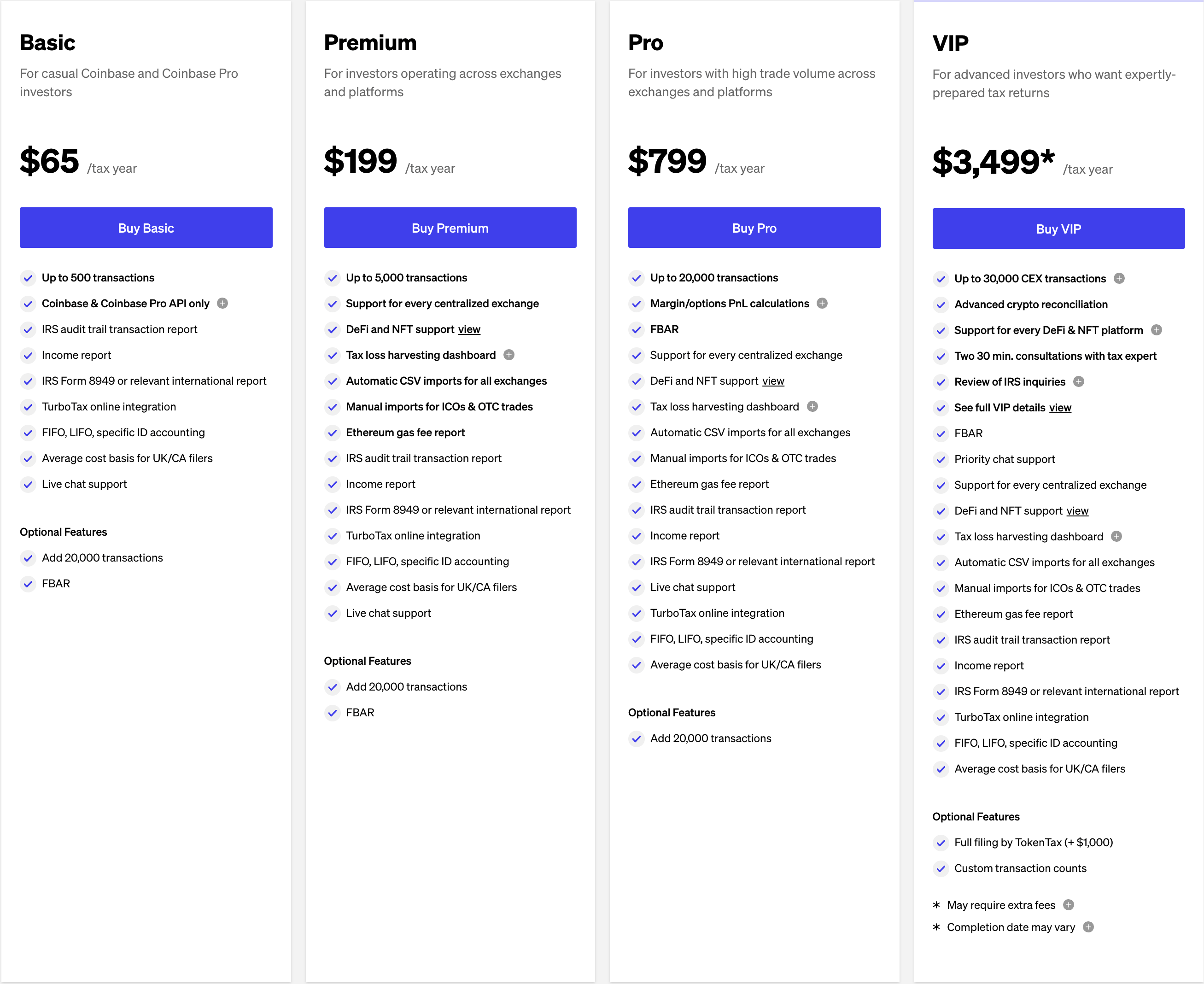

TokenTax offers four plans that cater to crypto traders and investors with a wide range of tax filing needs. The more exchanges and transactions you have, the higher the tier you’ll need, but higher-tier plans also offer additional services like tax-loss harvesting, Ethereum gas fee reports, and DeFi and NFT support.

TokenTax also supports trade data from every crypto exchange, protocol, blockchain, and wallet, so you can rest assured its services will apply to wherever your crypto was purchased, transferred, or sold.

One of the beauties of TokenTax’s crypto tax software is it makes sure to include features that apply to all varieties of crypto enthusiasts, from traders to investors to miners.

And in addition to supporting spot crypto asset transactions, TokenTax supports margin and futures trading, DeFi exchanges, and even NFT trades.

The TokenTax software is also equipped to handle any missing cost basis, high transaction volumes, and cross-chain transactions.

If you are a financial institution or high net worth individual deeply involved in crypto staking/mining and/or have a highly complex crypto tax situation, TokenTax is one of the best services available.

That being said, TokenTax is quite expensive compared to alternatives. If you want the software with the most features, TokenTax is an excellent choice, but you will certainly pay for all those bells and whistles.

Pros

- Supports every crypto exchange and wallet

- TurboTax integration

- Tax loss harvesting tool

- Mining and staking reports

- Ethereum gas fee report

Cons

- Basic plan only supports Coinbase

- Plans are very expensive relative to competitors

- No plan supports unlimited transactions

Koinly (Best Free Option)

Koinly is a crypto tax calculator for businesses, accountants, and retail investors that supports 400+ exchanges, 100+ wallets, and 170+ blockchains.

Koinly has four main features it provides through its crypto tax software: portfolio tracking, data importing, complete crypto tax reports, and error reconciliation.

With Koinly’s portfolio tracking tools, not only can you can view your total holdings and portfolio growth over time across all your wallets and accounts, but you can also view all your tax liabilities.

You’ll even see your ROI, dollar amount invested in each coin, profit/loss numbers, capital gains taxes, and an overview of your income taxes for mining, staking, lending, and other taxable income related to crypto.

Regarding tax reports, Koinly includes your transaction history, a capital gains tax report, an income tax report, an expense report, an end-of-year holdings report, a complete crypto tax report, and much more.

Koinly also lets you easily export your transactions to other tax software like TurboTax, TaxAct, and H&R, or download tax reports if you desire.

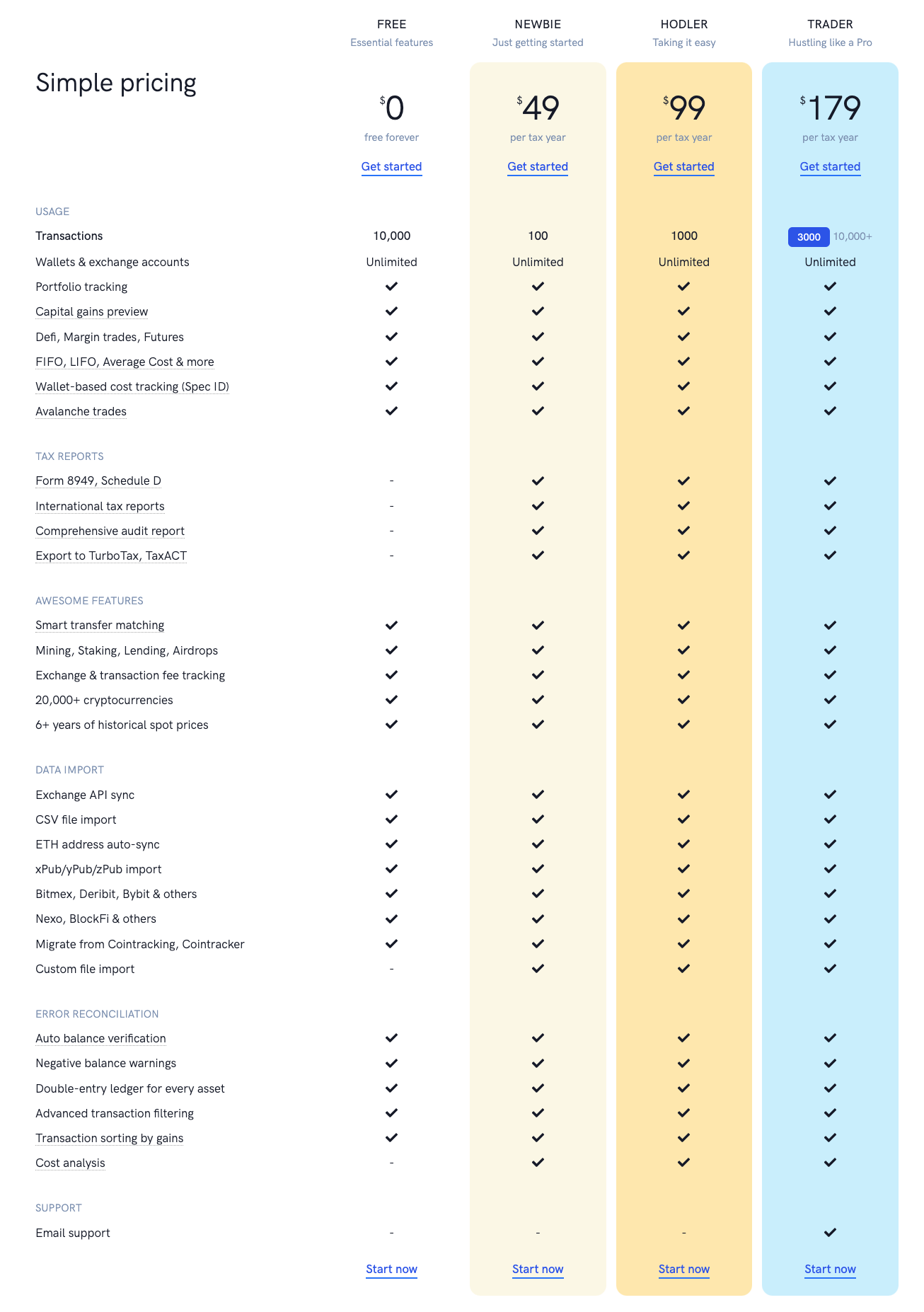

Koinly has four plans ranging from $0 to $179 per tax year. Its free plan includes up to 10,000 transactions, unlimited wallets and exchanges, portfolio tracking, a capital gains summary, and a fair amount more, so it is easily the best free crypto tax software solution.

Most people involved in the world of crypto don’t need many of the bells and whistles found on other platforms or within the more expensive plans, so Koinly will be an excellent choice for anyone looking for a simple solution to their crypto gains and losses.

In summary, Koinly is arguably the best free crypto tax service available, and its paid crypto tax services are also very respectable and affordable. It lacks many of the advanced features that other advanced platforms have, but those features won’t be necessary for most crypto investors or traders.

Pros

- Excellent Free plan

- Cross-exchange portfolio tracking

- Tons of learning resources

- Affordable paid plans

Cons

- No NFT tax reports

- No Ethereum gas fee reports

- No tax-loss harvesting reports

TaxBit (Best Overall)

TaxBit is an advanced crypto tax software and portfolio tracking service for individuals and businesses that supports over 500+ exchanges, wallets, DeFi protocols, and NFT marketplaces.

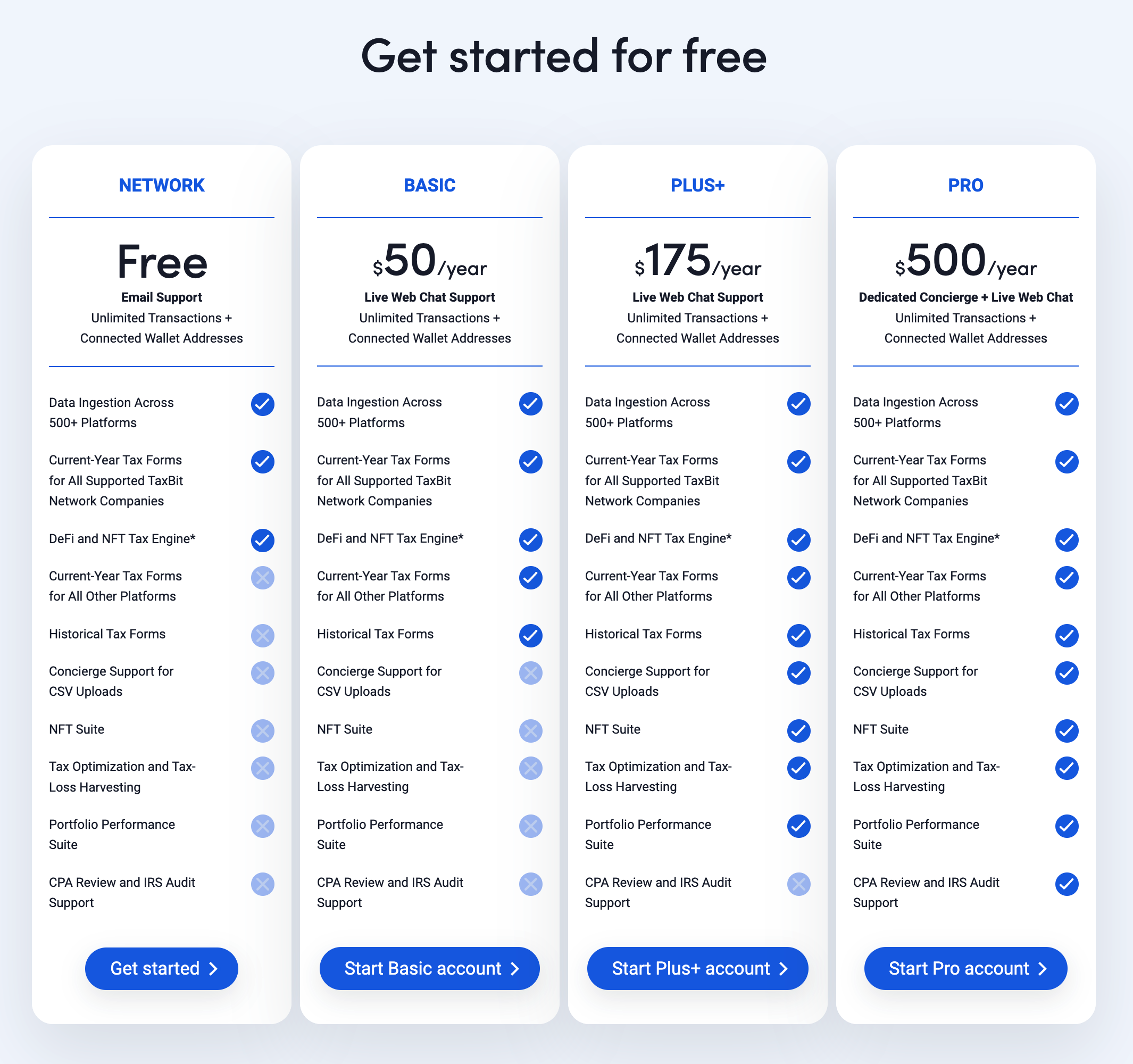

While TaxBit has several paid plans with advanced features, its free plan includes current-year tax forms, a DeFi and NFT tax engine, and allows you to integrate your cryptocurrency data across all its supported sources.

TaxBit does all the data normalization and tax calculations for you, so you can see the real-time tax impact of all your cryptocurrency use.

TaxBit can also provide real-time insights into the value of your portfolio and gives you the chance to optimize your tax-loss harvesting strategies.

In TaxBit’s Plus+ and Pro plans, you can actually see the tax impact of each trade before it's made, meaning it provides you with the data and recommendations on taxable events so you can save even more money when you pay taxes.

The Plus+ and Pro plans even give you access to full NFT and DeFi centers where you can see your actual NFTs, DeFi positions, and a corresponding performance analysis.

When it comes to TaxBit’s paid plans, it is closer to TokenTax in that it offers more advanced features like tax-loss harvesting and NFT functions, so individuals with more advanced tax needs might want to explore it as an alternative.

TaxBit ostensibly does everything TokenTax does, notwithstanding a few exceptions like gas fee and mining reports, but for a much lower yearly subscription. The most expensive plan, for example, is only $500 compared to TokenTax’s $3,499.

For that reason, TaxBit is a great best-of-both-worlds crypto tax solution, offering a healthy balance of advanced tax tools and affordability.

Pros

- Advanced features for a reasonable price

- Tax-loss harvesting reports

- Tracks portfolio performance, including NFT and DeFi crypto trades

- Includes a free plan with unlimited transactions

- CPA review for top-tier plan

Cons

- Free plan has limited features and tax documents

- No Ethereum gas fee reports

- No mining or staking reports

- Tax-loss harvesting only in $175+ plans

Conclusion

After carefully walking through all the different platforms for this crypto tax software review, we believe TokenTax is the best advanced platform, Koinly is the best free option, and TaxBit is the best overall choice.

TokenTax has all the most advanced features like average cost basis calculation, Ethereum gas fee reports, DeFi and NFT support, a tax-loss harvesting dashboard, and a number of other tools, but it doesn’t offer a free account.

If those specific features speak to you, TokenTax might be worth looking into, but for most intents and purposes, TaxBit will be a cheaper alternative with very similar functionality.

However, Koinly and its free plan should be more than enough for the average crypto investor, so it’s a must consider if your crypto tax needs are minimal.

Overall, the best tax filing software for your cryptocurrency taxes will depend on precisely what you need based on your crypto trading, mining, and staking circumstances.

Most crypto traders and investors will be fine using Koinly’s free plan, but if you have more advanced tax needs requiring advanced tools or tax professionals, TaxBit and TokenTax should be at or near the top of your list.

The latter is arguably the most advanced crypto tax software on the market, and the former is your slightly less advanced (and significantly cheaper) alternative.

We hope you enjoyed this best-of crypto tax software review and pray the headache of crypto taxes can now comfortably rest in your rear-view mirror.