- Investing

- >

- Portfolios

- >

- Balanced

- >

- The Dalio

The Dalio

This is a portfolio loosely based on the world-renowned investor Ray Dalio and his “all-weather” approach to asset allocation.

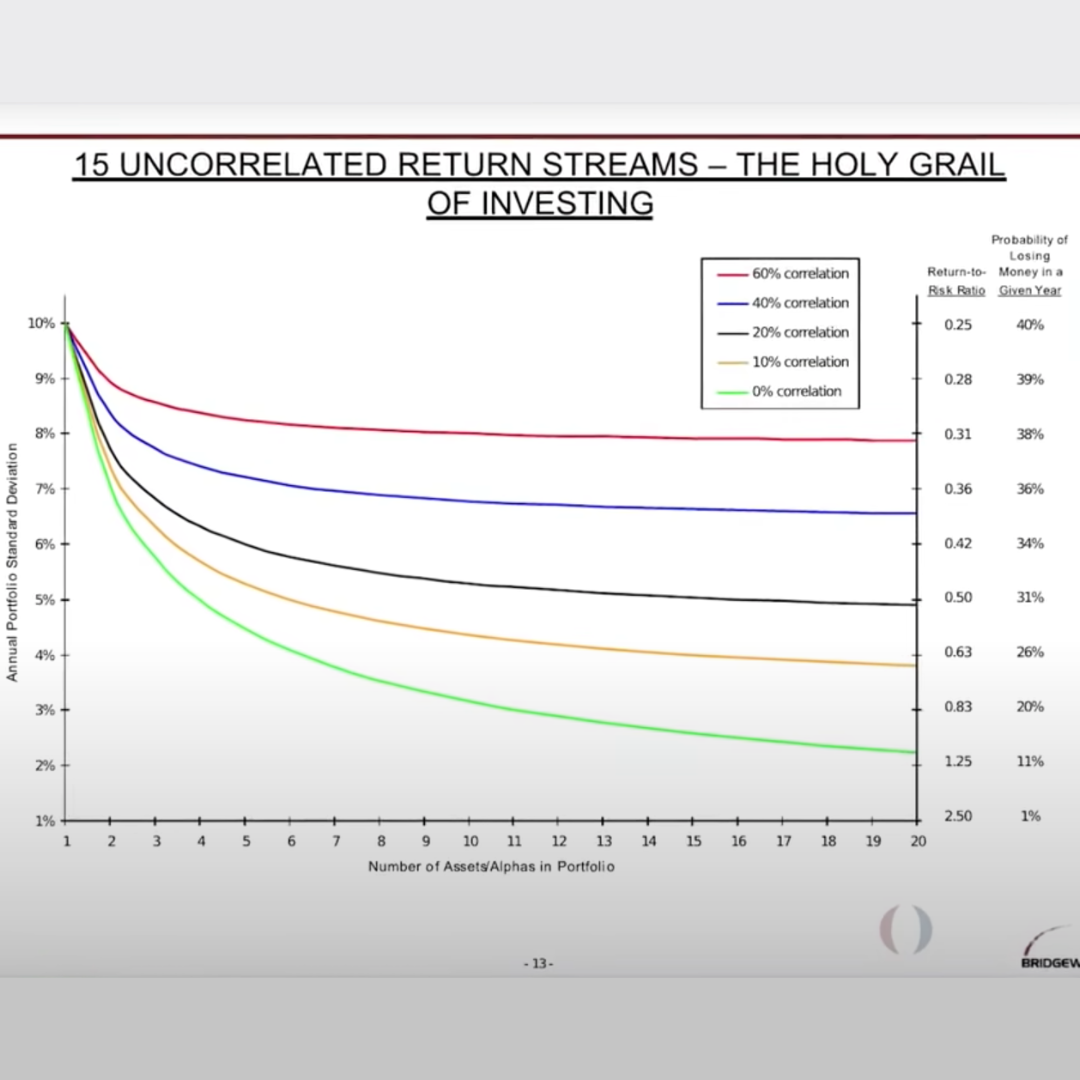

Ray Dalio is famous for what he coined the “holy grail” of investing, which refers to the role of non-correlation in reducing risk per unit of return.

Dalio and his hedge fund, Bridgewater Capital, found that holding just 15-20 non-correlated assets meaningfully diversifies one’s portfolio more than holding 1,000 assets that are, say, 60% correlated.

In other words, non-correlation is much more important to a portfolio's diversification than the number of investments.

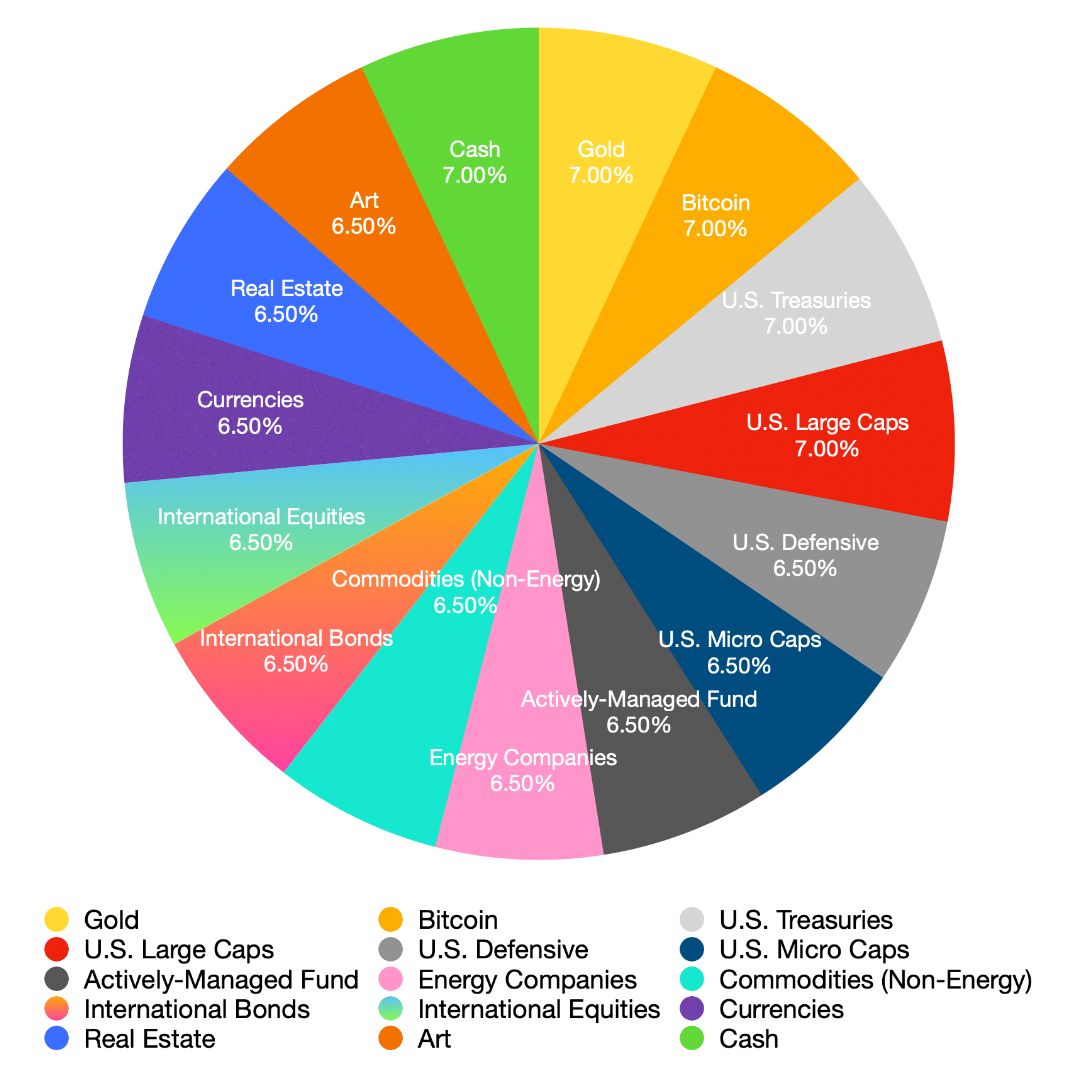

Consistent with this finding, this model portfolio aims to evenly diversify exposure across the most non-correlated asset classes.

In doing so, portfolio drawdown and volatility should be reduced relative to the overall market (as measured by a standard U.S. stock index like the S&P500) while achieving similar returns.

It should be noted, however, non-correlation is not a sufficient condition for generating alpha or even matching benchmark returns.

Finding *quality* investments is still paramount.

But with those 15-20 *quality* investments that have little correlation to one another, a portfolio can significantly reduce its risk while roughly matching the long-term returns of a benchmark index.

Asset Allocations:

- Gold

- Bitcoin

- U.S. Treasuries

- U.S. Large Caps

- U.S. Defensive (Utilities, Staples, Healthcare)

- U.S. Micro Caps

- Actively-Managed Fund

- Energy Companies

- Commodities (Non-Energy)

- International Bonds

- International Equities

- Currencies (EUR/USD, GBP/JPY, etc.)

- Real Estate

- Art

- Cash (Liquidity)

---------------------------------------------------------------------------------------

*All portfolio allocations illustrated or discussed, whether depicting asset classifications, categories, subcategories, or any specific asset, are for informational and educational purposes only. This is not investment advice.*

---------------------------------------------------------------------------------------