- Investing

- >

- Portfolios

- >

- Basic

- >

- Medium- to High-Risk

Medium- to High-Risk

This is a medium- to high-risk portfolio with three simple allocations to broad market indices.

This is a zero-alpha approach aimed at matching long-term market returns through total and market capitalization-weighted exposure in three major market indices.

Both low-risk and high-risk portfolios can focus their strategy on capturing broader market returns.

What determines how conservative or aggressive an investor is is their asset allocation strategy, not whether they are or are not trying to beat the market.

There are levels to "benchmark" returns depending on one's risk tolerance.

This is a moderate to aggressive approach to capturing broader market returns.

Rebalancing toward the below allocations should be executed twice a year.

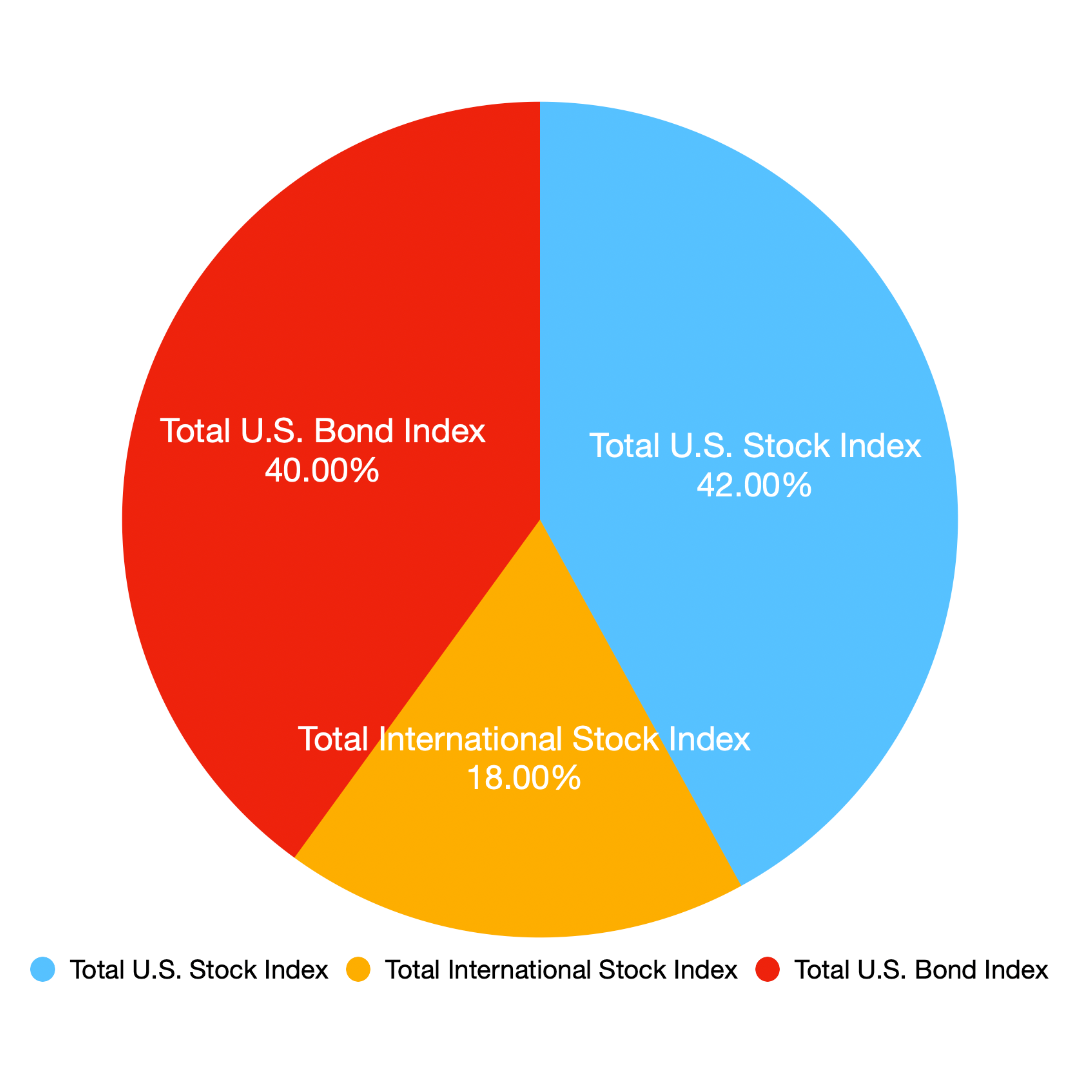

Medium- to High-Risk Portfolio:

- Total Stock Market Index - 42%

- Total International Stock Index - 18%

- Total Bond Market Index - 40%

Example Investment Vehicles:

- Total Stock Market Index - $VTI

- Total International Stock Index - $VTIAX

- Total Bond Market Index - $VBTLX

---------------------------------------------------------------------------------------

*All portfolio allocations illustrated or discussed, whether depicting asset classifications, categories, subcategories, or any specific asset, are for informational and educational purposes only. This is not investment advice.*

---------------------------------------------------------------------------------------