- Trading

- >

- Strategies

- >

- Wave Theory

Wave Theory

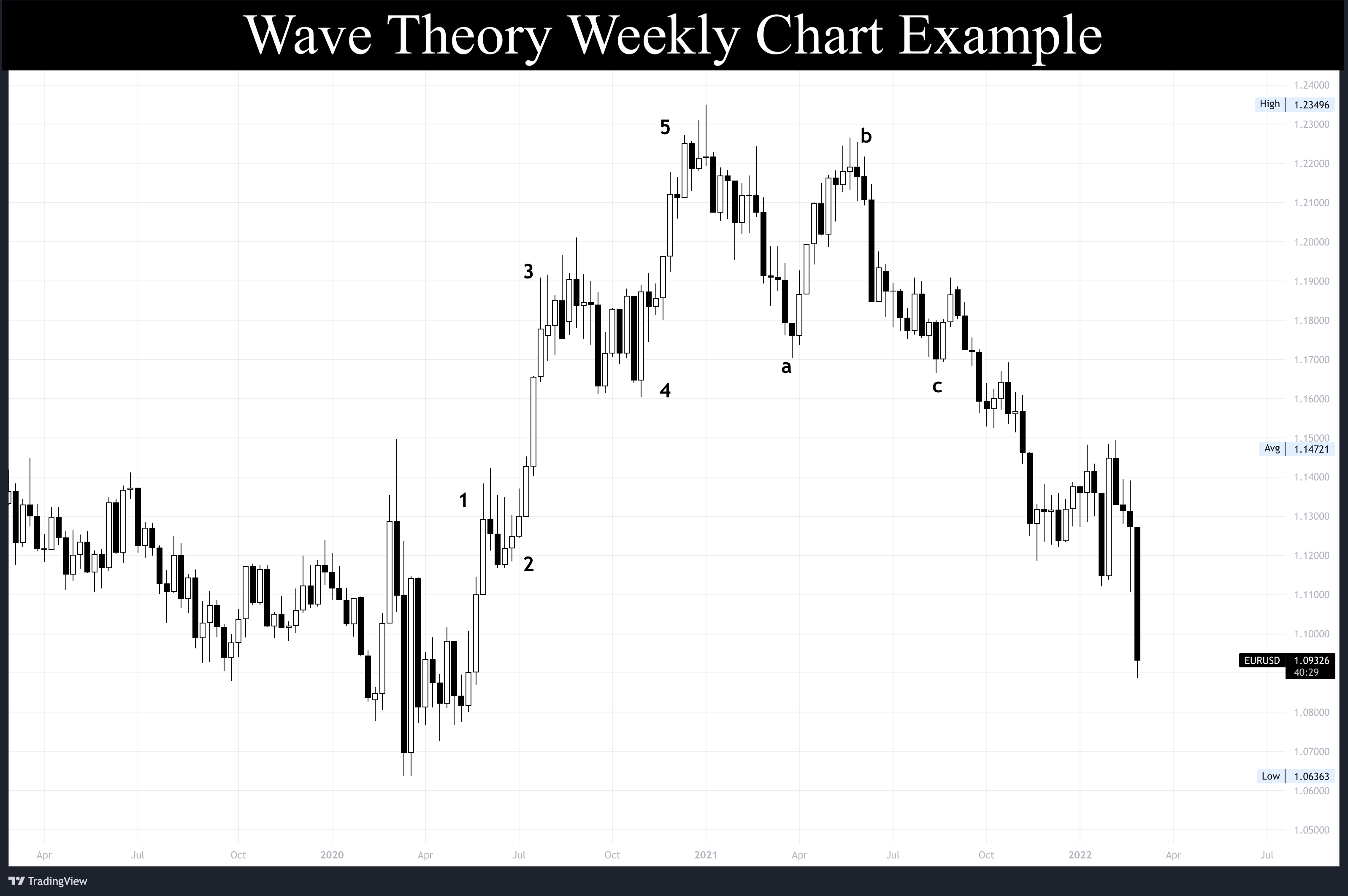

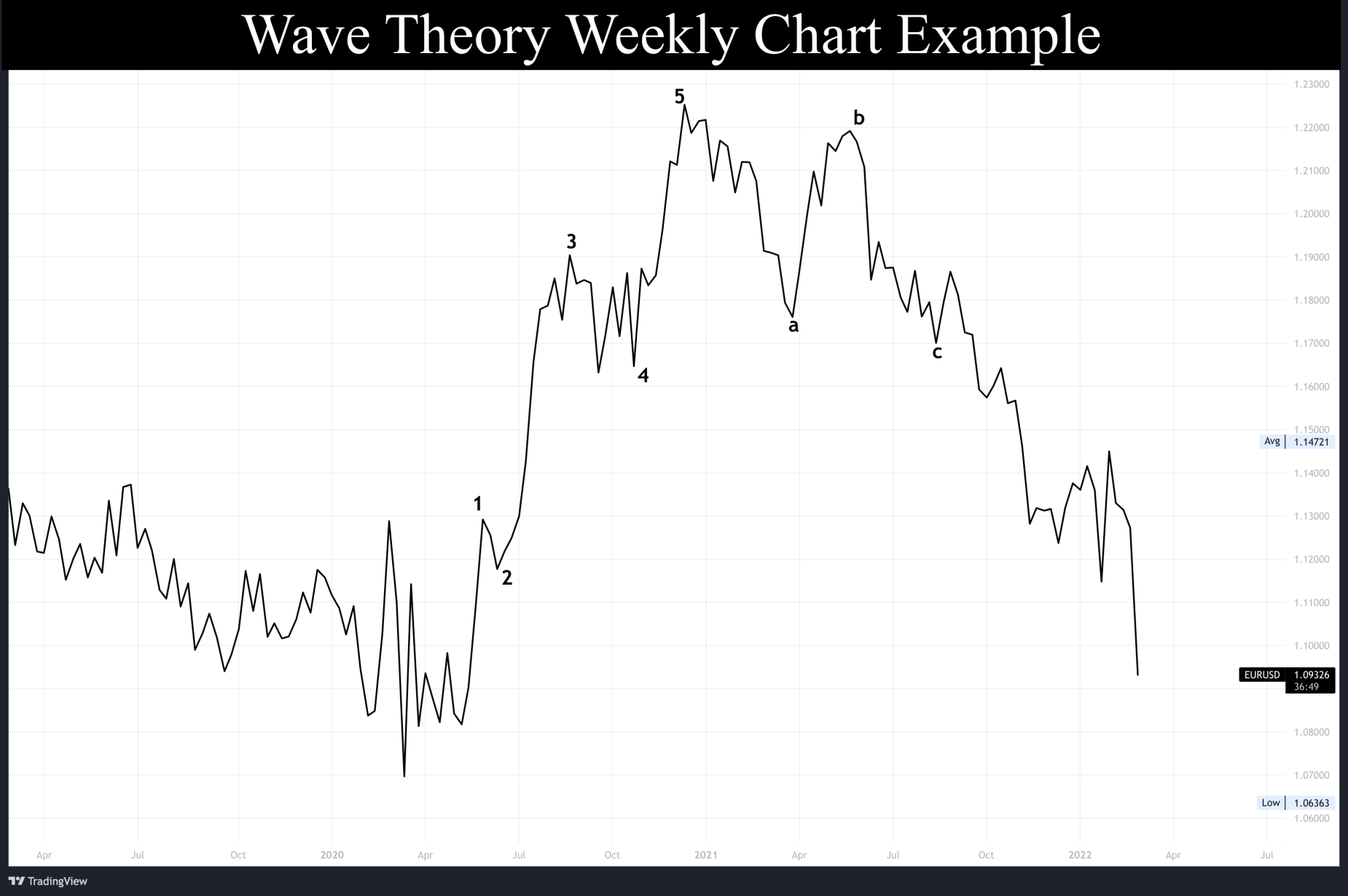

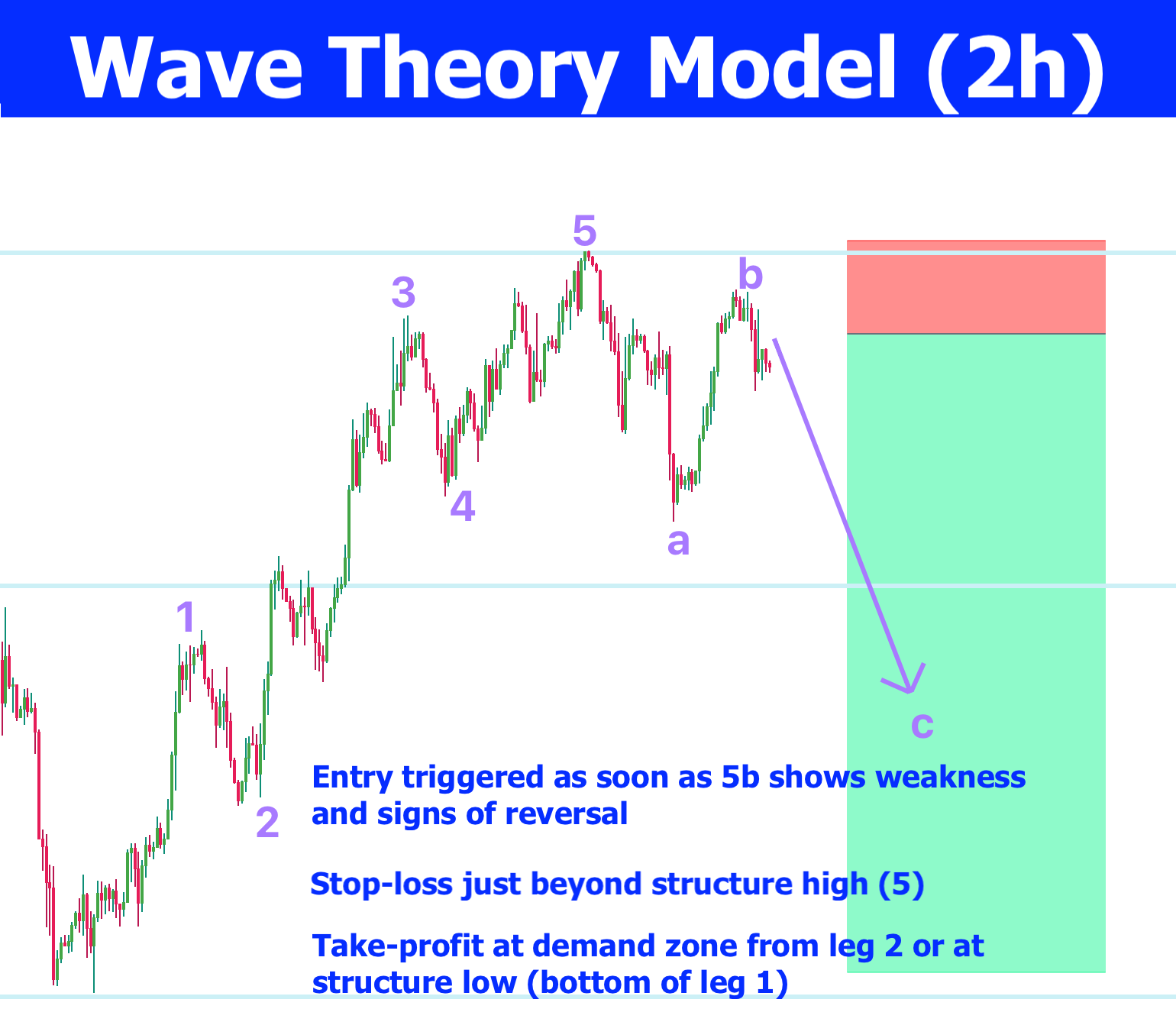

Wave theory is a form of technical analysis that looks for recurrent price patterns related to trader psychology.

Each set of waves is nested within a larger set of waves that follow the same pattern. These patterns emerge due to price trends largely being determined by investor psychology.

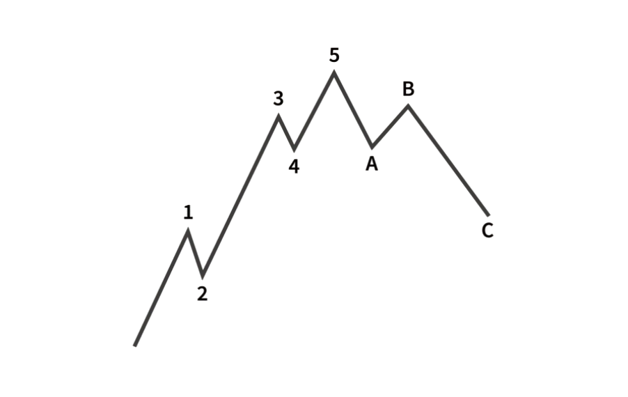

The theory suggests long-term upward price trends will consist of five waves before a long-term downtrend.

After the long-term downtrend has been completed, the cycle may repeat from point C.

The Five Waves:

- Impulse wave of initial excitement

- Corrective wave of A,B, C formation (as seen in figure 2)

- Strong impulse wave up to new highs

- Corrective wave of A,B, C formation (as seen in figure 2) 5. Smaller impulse wave to new highs (edited)

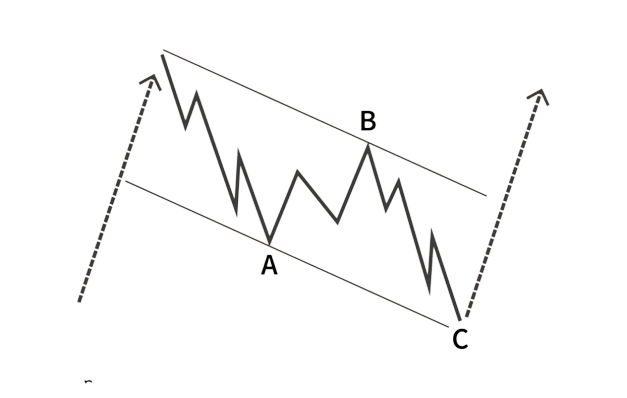

The corrective wave normally has three distinct price movements – two in the direction of the main correction (A and C) and one against it (B).

Waves 2 and 4 in the attached picture are corrections. These waves typically have a fractal ABC structure.

*Rules to remember*

1. Wave 3 shouldn’t ever be the shortest impulse wave.

2. Wave 2 shouldn’t ever go beyond the formation point of wave 1.

3. Wave 4 shouldn’t ever cross in the same price area as wave 1