- Trading

- >

- Strategies

- >

- The 3 Market Phases

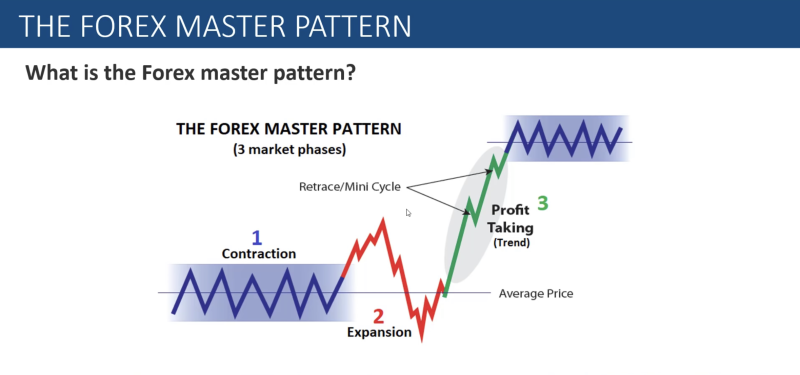

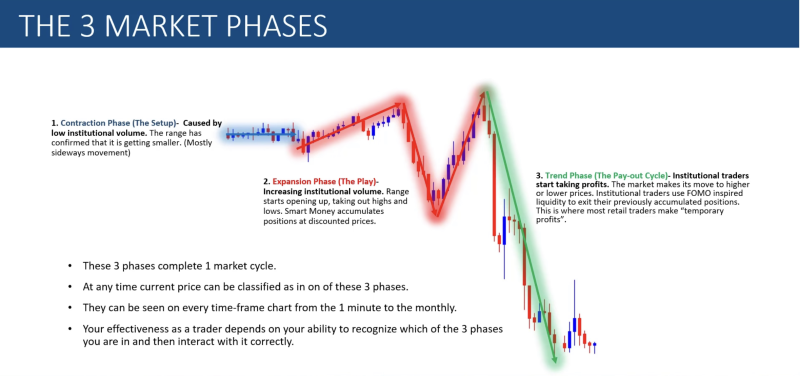

The 3 Market Phases

This is a strategy commonly used in forex, but it is applicable to all markets.

The strategy is based on a repeated and fractal market structure that result from market makers trying to grab liquidity from retail traders before establishing new trends.

Phase 1: Contraction/Consolidation

In the contraction/consolidation phase, price is usually tightening within a range and offering little opportunity for significant gains in either direction.

Phase 2: Expansion

In the expansion phase, price moves past the range-highs and/or range-lows of phase 1. This is done by market makers to trick traders into seeing a breakout, which allows them to grab liquidity and begin a strong move.

*Expansions frequently happen on both sides of the the range/consolidation area to grab as much liquidity as possible, so be prepared for pushes just above AND just below the range before a new trend is established.

Phase 3: Trend

The trend phase is where you will be trying to make your money. After phase 2, price will move back toward the range from its expansion and continue further into a whole new trend to the upside/downside.

Once you've recognized the consolidation and expansion outside the range to grab liquidity, all you have to do is hop in with a simple stop just outside the range and hold on for a potentially powerful trend shift.