- Trading

- >

- Basics

- >

- Indicators

- >

- ATR (Average True Range)

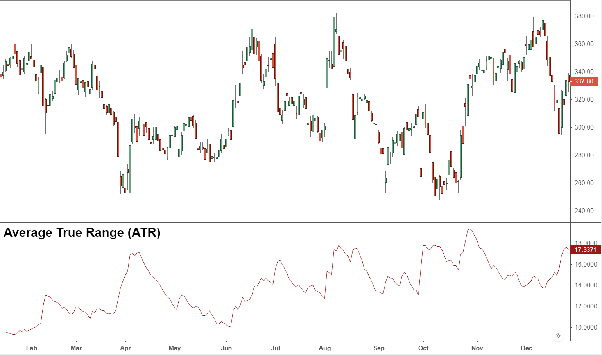

ATR (Average True Range)

SKU:

$0.00

Unavailable

per item

The Average True Range (ATR) is an indicator of the price volatility of assets over a specific period.

Average true range values are generally calculated based on 14 periods. The period can be monthly, weekly, daily, or even intraday.

A high value of the average true range implies high volatility of the market price of the assets and a low value implies low price variations.

If the average true range is expanding, it implies increasing volatility in the market, but the average true range is non-directional, meaning an expanding range can be an indication of either short sale or long buy.

The average true range is frequently used for entry or stop prompts.